-

About Us

About Us

The SIPC logo means your assets are protected under the Securities Investor Protection Act (SIPA).

We are a non-profit corporation that has been protecting investors for 50 years. We work to restore investors’ cash and securities when their brokerage firm fails. SIPC has recovered billions of dollars for investors. -

Cases & Claims

Cases & Claims

Steps SIPC takes to recover customer assets when a brokerage firm fails financially.

Find claim forms and deadlines for open cases here.SIPC has restored billions of dollars for investors. -

Investors

Investors

SIPC steps in when a brokerage firm fails financially, and assets are missing from customer accounts.

SIPC protects customer assets when a SIPC-member brokerage firm fails financially.

Understand how SIPC protection works if you have multiple accounts.SIPC has recovered billions of dollars for investors. Our job is to recover missing cash or securities if your brokerage firm has gone out of business. SIPC does not protect digital asset securities that are investment contracts that are not registered with the U.S. Securities and Exchange Commission, even if held by a SIPC member brokerage firm.

SIPC has issued Investor Bulletins explaining SIPC’s protection and claims process. Click here for Part I ("SIPC Basics"). Click here for Part II ("Filing a SIPC Claim").

-

Member Firms

Member Firms

Member Filing Requirements

Questions about filing requirements? Call the membership department at (202) 371-8300 or contact us.

Portal Information

Information about the SIPC broker-dealer portal.

-

News & Media

News & Media

-

Resources

Resources

- Contact Us

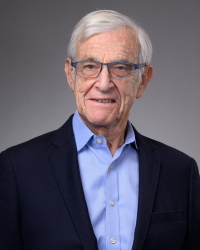

Alan J. Patricof is the Co-founder and Chairperson of Primetime Partners, an early-stage venture capital fund focused on servicing the aging population. A longtime innovator and advocate for venture capital, he entered the industry in its formative days with the creation of Patricof & Co. Ventures Inc., a predecessor to Apax Partners -today, one of the world's leading private equity firms with $75 billion under management. In 2006, he founded Greycroft Partners, a venture capital firm where he is currently Chairman Emeritus, to invest in leading early and expansion stage investments in digital media. With offices in New York and Los Angeles, Greycroft has $2B+under management. With a 50-plus year career in venture capital, Patricof has been instrumental in growing the venture capital field from a base of high net-worth individuals to its position today with broad institutional backing, as well as playing a key role in the essential legislative initiatives that have guided its evolution. He has helped build and foster the growth of numerous major global companies, including, among others, America Online, Office Depot, Cadence Systems, Cellular Communications, Inc., Apple Computer, FORE Systems, NTL, lntraLinks, Audible, Huffington Post and Axios. He was also a founder and Chairman of the Board of New York Magazine, which later acquired the Village Voice and New West magazine.

He is currently a board member of the Finance Committee of Northside Center for Child Development in Harlem, the Board of Overseers of Columbia School of Business and Fortune Society. He is also a member of the Council on Foreign Relations. Patricof holds a BS in Finance from Ohio State University and an MBA from Columbia University Graduate School of Business.